2930 W. Main St. Kalamazoo, MI. Inside Endurance Fitness & Wellness Gym

How does Cash Based PT Work?

Here's Why You Should Consider Cash Based PT Even if You Have Insurance

When people hear about cash based PT, they often ask, "Why would I ever choose to go out of network for my physical therapy when my insurance pays for it?"

Allow me to share with you the top 3 reasons why most of you needing therapy should find a cash-based PT even if your insurance "covers" PT. But before we begin with the first reason, some definitions & clarifications are in order.

In Network vs. Out of Network (OON)

In Network most simply means that the PT practice participates with your insurance. That is, there is a contract set between the clinic and the insurance company with pre-arranged payments for specific PT treatments. Out of Network refers to any PT clinic that does not have a contract with that specific insurance company. This means that the insurance company isn't likely to pay for those services or that they will pay a reduced amount.

Cash Based

Cash based or cash-pay PT describes a PT practice that has no contracts with insurance companies. These kinds of practices set a rate for their visits and their clients pay for visits either up front or at the time of service. This describes us at Strength & Shield.

Now we can dive into our top 3 reasons:

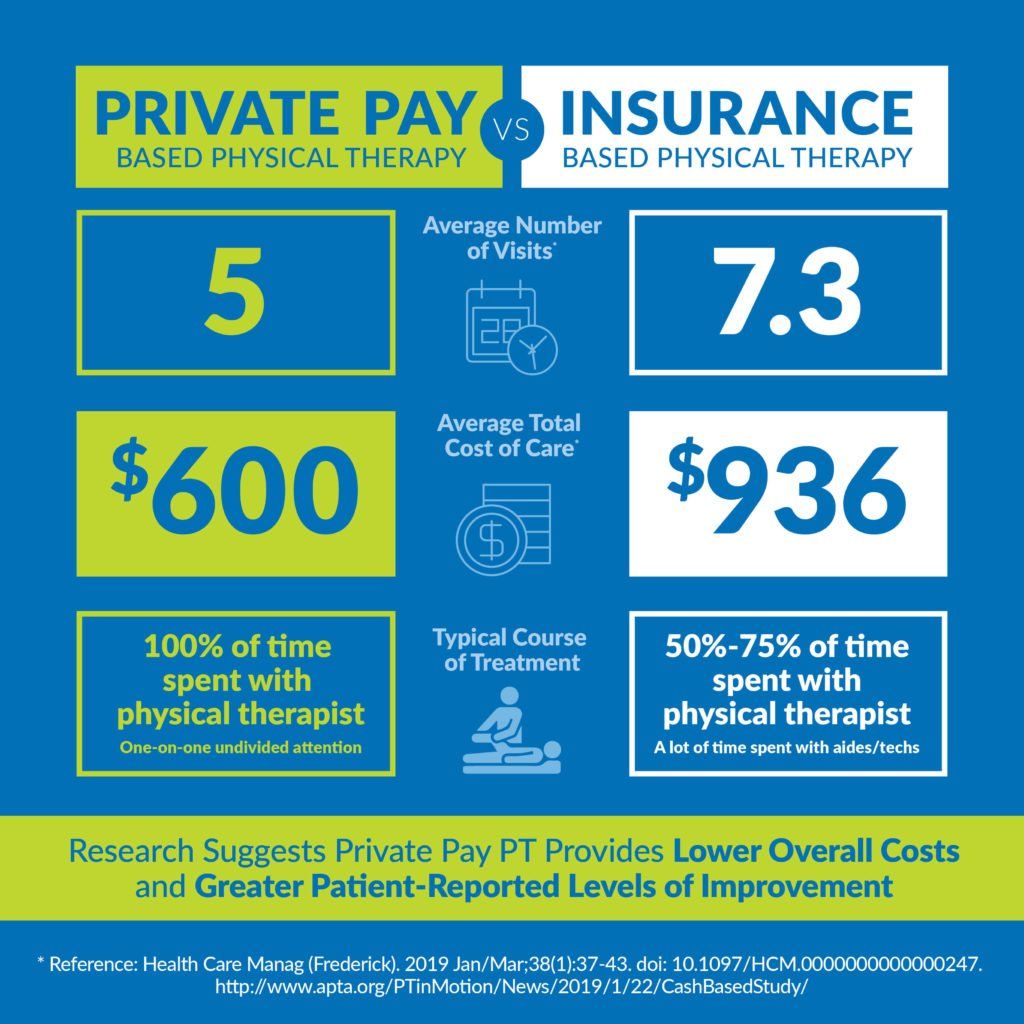

Reason #1: Cost - You may pay less out of pocket by going with a cash-based practice.

Your insurance deductible is the amount you must pay each year before the insurance company benefits start to kick in. If you haven't met your deductible and need PT, you will be paying whatever the PT clinic charges your insurance company even if they are in-network. This is important because most insurance PT clinics charge 1.5-2x or more what cash-based practices charge. Another important factor is that the average number of "insurance PT" visits is considerably higher than cash based. So, in summary, you will be charged more and will require more visits by going in-network with your insurance-participating clinic.

One side note: most insurance companies will accept OON (such as cash-based practices) services to count toward their deductible. We give our patients what is called a "superbill" which they submit to their insurance to be counted toward their deductible.

Reason #2: Quality - You will have the attention of the same therapist 100% of the time.

Of course not all "insurance PT" is the same, but in general, here's the life of the "insurance therapist": They see 12-15 patients (or more) in an 8-hour day, document all the insurance-required information, manage/direct PT assistants (PTA's) and review their notes. This means they are probably managing a total of about 40-50 patients at any given time along with their PTA's.

A cash-based PT (like us) usually spends a full hour with their patient 1-on-1 the whole time (most do not have PTA's, like us). They see 5-6 patients in a day (or 4-5 if mobile like us) and have no insurance demands upon their documentation. There are no PTA's to manage. And they are likely to be managing a total of about 10-20 patients at any given time.

Understanding that, who would you want caring for you? Who do you think will remember you and your situation and your goals? Who has more time and energy to dedicate to furthering their education?

Reason #3: Freedom - Your Cash PT has much more freedom than your Insurance PT

Many insurance companies are increasingly restricting visits through authorization requirements. This essentially means that insurance companies are playing the role of healthcare providers in deciding how much & what kind of any particular health service you get. Even if they don't (yet) require authorization, all insurance companies require ever-shifting standards that your "insurance PT's" must know about and comply with. Your cash-based PT is free to work with whatever your personal goals are. They are also free to shift the plan or frequency of visits without first obtaining the insurance company's approval.

For a deeper dive into some numbers and examples, see THIS BLOG POST.

Cash-based PT has been on the rise for a reason. Insurance companies are demanding more & more, yet paying less & less (for example, just this year, Medicare decreased their PT reimbursements by 8% in a day when the cost of everything is rising). "Insurance PT clinics" are scrambling to find ways to pay their therapists and keep their clinic lights on. The result is that they must demand each "insurance PT" to cram more clients into their day. Cash based PT removes the insurance factor and produces happier, more patient-focused & caring PT's. If you've never experienced PT from a cash based practice, you probably don't know what you're missing. Come and discover the difference!

What Should I Do to Find Out How Much I'll Be Paying?

If you want to know how much you'll be paying out of your pocket by going through your insurance and be able to compare it to cash pay, follow these steps:

Questions for your insurance company:

1) "What is my current deductible & what will my co-pay be for PT?"

2) "Until I meet my deductible, what can I expect to pay for each session of PT at an in-network clinic?"

(They may only be able to give percentages, but in general, PT clinics are likely billing at least $150 per session to the insurance company, and usually over $200/session. Our 1-hour session is between $90-$115.)

3) "What can I expect in reimbursement or application to deductible if I get PT at an out-of-network provider, and send in self-claims"

(This is important: insurance companies' customer service agents are usually instructed to discourage people from going to clinics that are not in-network. They will have no good answer for why they discourage this, however.)

Questions for your In-Network PT clinic:

1) "On average, how many patients per hour do your providers treat?"

2) "Are only physical therapists providing care, or do you use assistants and techs?"

3) "How much one-on-one time will I get with my physical therapist in each session?"

4) "On average, how many times per week do your patients come in for treatment?"

This will give you a good idea of what will be coming out of your pocket by going in-network with less than stellar PT versus cash-pay. Here is an example scenario:

| Cash Pay PT | Insurance PT | |

|---|---|---|

| Cost per reg session | $90-115 | $150-300 |

| Patients treated per hour | 1 | 2 |

| PT's, assistants, techs? | Doctor of PT only | PT's, assistance, techs likely |

| 1-on-1 time with my PT | 100% | 50-75% |

| Avg visits per week | 0.5 - 1 | 2-3 |

| Avg visits per episode | 6 | 12+ |

| Total Cost Out of Pocket | $660* | $2,700* |

| * Your insurance may cover a portion of this amount once deductible is met. This counts toward your deductible in nearly all cases. | * You will be responsible for this amount if deductible is not met. |

Next week: We will talk about the

"direct primary care physicians" model and why this is so exciting in a similar was as cash-based PT. We pray you found this helpful in stewarding your body to the glory of God.

New Paragraph

"The LORD is my strength and my shield; in Him my heart trusts, and I am helped; my heart exults, and with my song I give thanks to Him." - Psalm 28:7

269 . 276 . 6742

(Fax: 269.397.2147)

2930 W. Main Street

Suite #1

Kalamazoo, MI 49006

<Call for office hours>

DrJon@SSmobilePT.com